Limited Time Offer: Get All Access Pass For Only $9/Month

CLICK HERE TO START

Technology Courses

Databases Courses

Filters

Courses to get you started

Discover More In Databases Courses

Filters

Databases Courses

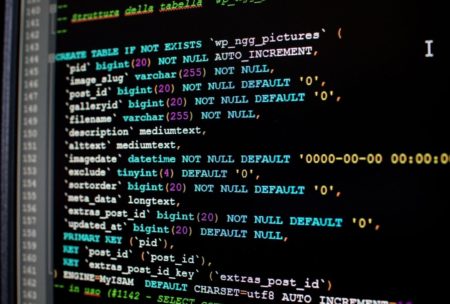

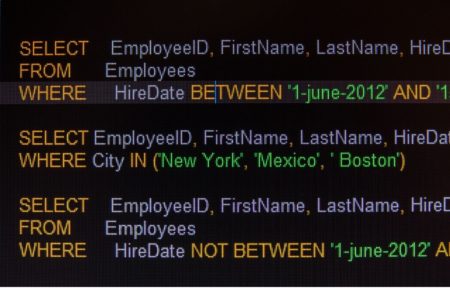

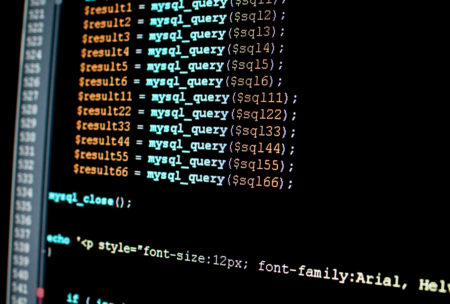

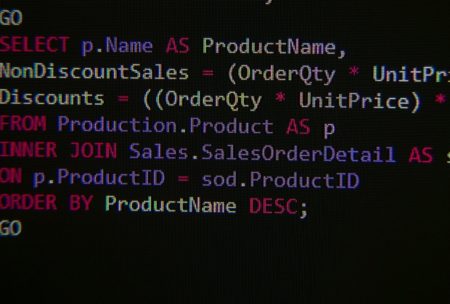

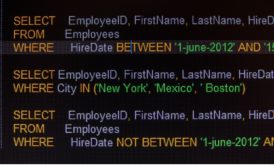

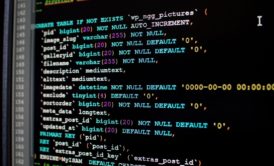

Programming means integrating a constantly evolving computer language, and so it is critical to effectively learn its data structure. At Skill Success, our courses are designed to help you to understand and master Javascript, SQL server database, Google Web Apps, and many more programs. By the end of these lessons, you will be able to better grasp the concepts of data functions, stored procedures, relational models, autoreports, and many other core database fundamentals for beginners. Not only will programming become easier, learning the basics will help you become more comfortable understanding regular future updates. Get started today and jumpstart your career!